Blog

Bankruptcy Leads for Real Estate Investors

Direct Marketing Statistics 2025: What Every Marketer Needs to Know

The Importance of Email Verification in Enhancing Marketing List Quality

How Mortgage Mailing Lists Enhance Direct Mail Marketing to High-Intent Borrowers

Why a Mailing List of Families with High School-Aged Children is a Powerful Sales Tool

Leveraging Data-Driven Mailing Lists to Enhance Direct Mail Campaigns

Seasonal Strategies for Targeting New Homeowners and Distressed Property Leads in 2025

How to Use Pre-Foreclosure and Absentee Owner Lists to Boost Real Estate Investment Returns

3 Top Mistakes Companies Make with Email Campaigns and How to Avoid Them

The Importance of Segmenting Your Target Audience According to Lifestyle

How to Market to Bankruptcy Leads

The Ins and Outs of Email and Data Appends

Direct Mail Continues to Offer a Strong ROI

Bankruptcy Leads for Real Estate Investors

Bankruptcy Leads for Real Estate Investors

How Lead Dog Information Services Gives You an Edge

In today’s competitive real estate investing market, finding motivated sellers before everyone else does can make the difference between closing profitable deals and wasting marketing dollars. One of the most underused yet highly effective data sources for motivated sellers are bankruptcy lists. When used ethically and strategically, bankruptcy data can help investors, wholesalers, and agents connect with property owners who may be actively seeking solutions.

This is where Lead Dog Information Services stands out. With accurate, timely, and investor-focused bankruptcy leads, Lead Dog helps real estate professionals identify opportunities early and market smarter—not harder.

What Are Bankruptcy Leads?

Bankruptcy leads are records of individuals or entities that have recently filed for bankruptcy protection, most commonly Chapter 7 or Chapter 13. These filings are public records and often indicate financial distress, which may include difficulty maintaining property payments, managing debt, or keeping up with property taxes and repairs.

For real estate investors, bankruptcy filings can signal:

- Property owners facing foreclosure or mounting debt

- Sellers who may be open to creative solutions

- Homeowners seeking to avoid long, costly legal processes

- Individuals motivated to sell quickly and discreetly

Unlike broad absentee owner lists or general distress data, bankruptcy leads are high-intent. These are people actively dealing with a financial event that may require immediate action.

Why Bankruptcy Leads Matter for Investors

Looking to reach motivated property owners before they list or lose the property? Many investors use bankruptcy leads as a quiet but effective way to open conversations early.

By working with a specialized data provider like Lead Dog Information Services, investors can focus on verified, property-matched bankruptcy leads instead of wasting budget on broad or outdated lists.

Bankruptcy lists provide several advantages over traditional marketing lists:

1. Less Competition: Many investors avoid bankruptcy data because they assume it’s complicated or sensitive. In reality, this means fewer competitors targeting the same prospects.

2. Strong Motivation Signals: A bankruptcy filing is not casual—it’s a serious financial decision. Property owners in this situation are often more responsive to well-timed, respectful outreach.

3. Opportunity for Creative Deals: Bankruptcy leads are ideal for subject-to deals, short sales, cash purchases, or problem-solving

approaches that benefit both the investor and the seller.

4. Better ROI on Marketing: When you focus on motivated sellers, your response rates improve and your cost per deal

decreases.

The Importance of Accurate, Compliant Data

Not all bankruptcy data is created equal. Outdated or incomplete records can waste time, money, and credibility. Additionally, compliance matters. Investors must understand how to market ethically and in accordance with federal and state regulations.

This is where working with a specialized data provider becomes critical.

How Lead Dog Information Services Helps

Lead Dog Information Services provides real estate investors with reliable, up-to-date bankruptcy leads designed specifically for investor marketing campaigns. Unlike generic data brokers, Lead Dog understands how investors actually use data in the real world.

Here’s what sets Lead Dog apart:

1. Timely, Actionable Bankruptcy Data: Lead Dog delivers current bankruptcy filings so you can reach prospects early—when options are still available. Timing is critical with bankruptcy leads, and outdated data simply doesn’t perform.

2. Property-Matched Bankruptcy Leads: Bankruptcy filings alone aren’t enough. Lead Dog matches bankruptcy records against a national

property database, helping ensure that you’re marketing to property owners, not just filers with no real estate interest.

3. Nationwide Coverage: Lead Dog offers nationwide bankruptcy data, making it ideal for investors operating in multiple markets or building scalable acquisition systems.

4. Optional Phone and Email Appends: Need to reach prospects beyond direct mail? Lead Dog offers bankruptcy lists with optional phone and email appends, allowing you to run multi-channel campaigns that include:

- Direct mail

- Cold calling

- SMS marketing (where legally permitted)

- Email outreach

Multi-touch campaigns consistently outperform single-channel strategies.

5. Investor-Focused Support: Lead Dog Information Services works with real estate investors every day. The data is structured for easy upload into CRMs, dialers, and mailing platforms, saving you time and reducing friction.

Best Practices for Marketing to Bankruptcy Leads

Bankruptcy leads require a thoughtful, respectful approach. Investors who succeed in this niche focus on problem-solving, not pressure.

Tips for effective bankruptcy marketing:

- Use neutral, helpful language in mailers

- Avoid fear-based messaging

- Offer options, not ultimatums

- Be clear that you are not an attorney

- Focus on solutions like fast closings or debt relief through sale

Handled correctly, bankruptcy leads can produce strong results while building long-term

credibility.

Get Access to High-Intent Bankruptcy Leads

Stop competing over the same tired lists. Reach motivated property owners with timely, property-matched bankruptcy data.

Who Should Use Bankruptcy Leads?

Bankruptcy leads are ideal for:

- Real estate investors

- Wholesalers

- Cash home buyers

- Hybrid agents/investors

- Acquisition teams

If your business relies on finding motivated sellers before they hit the open market, bankruptcy data should be part of your lead mix.

Why Choose Lead Dog Information Services

At the end of the day, your results depend on the quality of your data. Lead Dog Information Services combines accuracy, speed, and investor insight to deliver bankruptcy leads that actually convert.

Whether you’re testing bankruptcy data for the first time or scaling an established acquisition strategy, Lead Dog provides the tools and support you need to compete.

Internal Call to Action: Turn Bankruptcy Data Into Deals

If you’re ready to add bankruptcy leads to your marketing mix, the right data partner matters. Working with a provider that understands real estate investing—not just raw data—can dramatically improve your results.

Lead Dog Information Services makes it easy to get started with bankruptcy leads that are:

- Timely and actionable

- Matched to verified property ownership

- Available nationwide

- Structured for investor marketing systems

Whether you’re running direct mail, skip tracing for calls, or building multi-channel campaigns, Lead Dog’s bankruptcy data helps you focus on sellers with real motivation.

Ready to get started? Visit our Bankruptcy Lists page or contact us to explore pricing, or learn how Lead Dog can support your acquisition strategy.

In a crowded market, smart investors look beyond the obvious lists. Bankruptcy leads offer a powerful way to reach motivated property owners with less competition and stronger intent. With the right data partner, these leads can become a consistent source of profitable deals.

Lead Dog Information Services helps investors do exactly that—by delivering reliable bankruptcy leads that turn outreach into opportunity.

Direct Marketing Statistics 2025: What Every Marketer Needs to Know

In an era where digital channels dominate the conversation, it’s easy to assume that direct marketing is fading into the background. But the truth is quite the opposite. As we move through 2025, direct marketing statistics reveal a compelling reality: when fueled by high-quality data, direct mail, email marketing, and targeted telemarketing remain some of the most ROI-rich tactics in the marketer’s toolbox.

Whether you’re a seasoned marketer or a business owner planning your next campaign, understanding how direct marketing performs in 2025—and how to improve your own results—is crucial. Let’s dive into the latest direct marketing statistics 2025 and explore how smart strategy and clean data can drive real results.

Section 1: Key Direct Marketing ROI Statistics

Despite digital noise, direct mail continues to pull its weight—and then some. According to the Data & Marketing Association (DMA):

- The average ROI for direct mail is $4.09 for every $1 spent, outperforming online display ads, which average $2.63 per dollar spent.

- Personalized direct mail pieces have a response rate of 6.6%, compared to just 2% for non-personalized mailers.

Segmented and data-driven lists make all the difference. Campaigns using segmented mailing lists see a 760% increase in revenue compared to those using mass, generic lists (HubSpot, 2024).

Meanwhile, email marketing—another pillar of direct outreach—boasts an ROI of $36 for every $1 spent, particularly when paired with accurate and verified contact data (Statista, 2025).

When it comes to mailing list response rates, curated data wins. Marketers using targeted lists, such as late mortgage leads or absentee owners, see open and engagement rates nearly double compared to generic lists.

Recommended Sources:

Section 2: Why Data Quality Makes or Breaks Your Campaign

In direct marketing, poor data is more than an inconvenience—it’s a budget killer.

- USPS estimates that undeliverable-as-addressed (UAA) mail costs U.S. businesses over $1.5 billion annually.

- Email marketing lists with unverified addresses can lead to bounce rates exceeding 30%, especially when data isn’t regularly cleaned or appended.

On the flip side, companies that use verified, curated lists for direct marketing enjoy:

- Improved response rates by 20–40%

- Faster campaign execution

- Lowered telemarketing compliance risk

Case in point: A real estate investor targeting vacant properties and late mortgage leads saw a 32% increase in appointment-setting success after switching from a generic list to a verified, segmented one provided by Lead Dog.

Other list types that routinely perform well include:

- Absentee owners

- Probate data

- Bankruptcy filings

Combined with email/phone appending, these lists enable omnichannel outreach—reaching leads through their preferred channel, be it mail, email, or phone.

Section 3: Trends to Watch in 2025

This year is shaping up to be a breakout for data-driven direct marketing, with several key trends emerging:

- Hyper-Personalization at Scale

Advancements in AI allow marketers to craft highly targeted campaigns across channels—whether through dynamic direct mail pieces or behaviorally-triggered emails. This increases relevance and conversion.

- AI-Powered List Enhancement

Tools like predictive modeling and automation platforms are enhancing segmentation, making it easier to identify high-potential prospects and improve message timing.

- Cross-Channel Integration

The future is omnichannel. Leading marketers are blending direct mail, email marketing, and phone outreach into unified campaigns. Response tracking and A/B testing are becoming more advanced, enabling real-time optimization.

- Regulatory Awareness

As telemarketing and data privacy laws evolve, compliance tools are becoming more essential. Lists that are scrubbed against the Do Not Call Registry and verified for email permissions help ensure you’re staying on the right side of regulations.

Predictions for 2025 suggest:

- A 10–15% rise in email deliverability when using appended and verified data

- A 20%+ increase in telemarketing effectiveness when targeting niche, pre-qualified segments

- Continued dominance of direct mail ROI, especially when combined with digital follow-up

Section 4: How to Act on These Stats

So how can you apply these insights?

Start With the Right Data

Instead of casting a wide net, start with high-intent leads tailored to your offer. At Lead Dog, we provide industry-leading lists across multiple verticals, including:

- Late Mortgage Files (with LTV options)

- Absentee Owners

- Vacant Homes

- Probate and Bankruptcy Data

These lists are available nationwide (except probate), and can be enhanced with email and phone appending for seamless omnichannel outreach.

Clean and Append Your Existing Lists

If you already have customer data, don’t let it go stale. Our data hygiene and appending services can breathe new life into your list by correcting outdated information and adding missing contact details.

Test, Track, and Refine

Launch your campaign with A/B testing across list types, channels, and creative. Measure response rates, cost per lead, and conversions. Use this data to continually refine your targeting strategy.

Need help selecting the right audience or cleaning your existing list? Contact our specialists to get started.

Closing Thoughts

The direct marketing statistics 2025 reveal a powerful truth: when fueled by clean, segmented, and verified data, direct marketing doesn’t just survive—it thrives. With impressive ROI, strong engagement rates, and expanding omnichannel capabilities, direct outreach remains a top performer for savvy marketers.

Whether you’re mailing, emailing, or dialing, smart data is the fuel that drives campaign success. At Lead Dog, we specialize in helping you reach the right audience with the right message—at the right time.

Ready to boost your next campaign? Speak to a specialist today and start converting smarter.

The Importance of Email Verification in Enhancing Marketing List Quality

In today’s digital marketing landscape, email remains a cornerstone for engaging with audiences, nurturing leads, and driving conversions. However, the effectiveness of email campaigns is heavily dependent on the quality of your marketing list. Implementing robust email verification processes is essential to ensure that your messages reach valid, engaged recipients, thereby enhancing overall campaign performance.

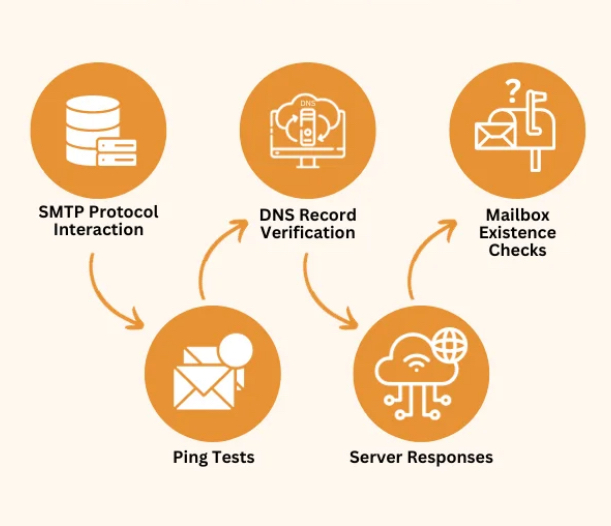

Understanding Email Verification

Email verification is the process of validating the accuracy and authenticity of email addresses in your marketing list. This involves checking each address to confirm it is properly formatted, exists, and is capable of receiving emails. By identifying and removing invalid or inactive addresses, businesses can maintain a clean and efficient email list.

The Impact of Unverified Email Lists

Utilizing unverified email lists can lead to several detrimental outcomes:

- High Bounce Rates: Sending emails to invalid addresses results in undeliverable messages, increasing your bounce rate. A high bounce rate can damage your sender reputation and may lead to your emails being marked as spam.

- Reduced Engagement: Emails sent to inactive or incorrect addresses won’t reach the intended recipients, leading to lower open and click-through rates.

- Risk of Blacklisting: Consistently sending emails to invalid addresses can trigger spam filters and result in your domain being blacklisted, severely impacting deliverability.

Benefits of Email Verification

Implementing email verification offers numerous advantages:

- Improved Deliverability: By ensuring emails are sent to valid addresses, you increase the likelihood of your messages reaching the inbox.

- Enhanced Engagement Rates: A clean email list means your content reaches real, interested recipients, leading to higher open and click-through rates.

- Cost Efficiency: Reducing the number of undeliverable emails means you’re not wasting resources on futile sends, optimizing your marketing budget.

- Protection of Sender Reputation: Maintaining a low bounce rate and avoiding spam traps helps preserve your domain’s credibility with Internet Service Providers (ISPs).Email Thrive

Best Practices for Email Verification

To maximize the effectiveness of your email verification efforts, consider the following best practices:

- Regularly Cleanse Your Email List: Periodically remove inactive or unresponsive contacts to maintain list hygiene.

- Implement Real-Time Verification: Use real-time email verification APIs at the point of capture to prevent invalid addresses from entering your list.

- Use Double Opt-In Methods: Require new subscribers to confirm their email addresses, ensuring validity and interest.

- Monitor Engagement Metrics: Keep an eye on open rates, click-through rates, and bounce rates to identify and address potential issues promptly.

- Choose a Reliable Verification Service: Select an email verification provider that offers high accuracy, scalability, and robust customer support.

Selecting an Email Verification Service

When choosing an email verification service, consider the following factors:

- Accuracy: Ensure the service has a high accuracy rate in detecting invalid addresses.

- Speed: The verification process should be quick to avoid delays in your campaigns.

- Integration: The service should easily integrate with your existing email marketing platform.

- Compliance: Verify that the provider complies with data protection regulations to safeguard your subscribers’ information.

For businesses seeking comprehensive email verification solutions, MyLeadDog offers a suite of services designed to enhance your marketing list quality and campaign effectiveness.

Conclusion

Incorporating robust email verification processes is crucial for maintaining a high-quality marketing list. By ensuring your emails reach valid and engaged recipients, you can improve deliverability, enhance engagement rates, and protect your sender reputation. Implementing best practices and selecting a reliable verification service will position your email marketing campaigns for greater success.EmailTooltester.com.

How Mortgage Mailing Lists Enhance Direct Mail Marketing to High-Intent Borrowers

In today’s competitive mortgage industry, reaching potential borrowers requires precision and strategy. Direct mail marketing remains a powerful tool, especially when combined with targeted mortgage mailing lists. These lists enable marketers to connect with high-intent borrowers, increasing the likelihood of conversions and maximizing return on investment.

Understanding Mortgage Mailing Lists

Mortgage mailing lists are curated databases containing detailed information about individuals who have shown interest in mortgage products or currently hold mortgages. These lists can include data on loan types, credit scores, property values, and more. By utilizing such comprehensive data, direct mail marketers can craft personalized campaigns that resonate with the specific needs and circumstances of their target audience.

Benefits of Using Mortgage Mailing Lists in Direct Mail Marketing

- Precision Targeting: Access to detailed borrower information allows marketers to segment audiences based on specific criteria such as loan type, credit status, and borrowing intent. This ensures that marketing materials reach individuals most likely to respond positively.

- Enhanced Personalization: With insights from mortgage mailing lists, marketers can tailor their messages to address the unique needs of each segment, making the communication more relevant and engaging.

- Improved Response Rates: Targeted and personalized direct mail campaigns are more likely to capture the recipient’s attention, leading to higher response rates and, ultimately, more conversions.

- Cost-Effective Marketing: By focusing efforts on high-intent borrowers, marketers can optimize their budgets, reducing waste associated with broad, untargeted campaigns.

Segmenting Mortgage Mailing Lists for Maximum Impact

Effective segmentation of mortgage mailing lists is crucial for the success of direct mail campaigns. Here are key segmentation strategies:

- By Loan Type

Different borrowers have varying needs based on their loan types. Segmenting lists into categories such as first-time homebuyers, refinancers, or reverse mortgage candidates allows for tailored messaging that speaks directly to each group’s circumstances. - By Credit Status

Understanding a borrower’s credit status enables marketers to offer appropriate products and solutions. For instance, individuals with higher credit scores might be interested in premium loan products, while those with lower scores could benefit from programs designed to improve creditworthiness. - By Borrowing Intent

Identifying where potential borrowers are in their decision-making process allows for timely and relevant outreach. Some individuals may be in the early research phase, while others are ready to commit. Tailoring messages to align with their intent can significantly influence conversion rates.

Crafting Compelling Direct Mail Campaigns

Once the mortgage mailing list is effectively segmented, the next step is to create engaging and persuasive mailers. Here are best practices to consider:

- Personalization

Utilize the data from your mailing lists to personalize each mailer. Address recipients by name and reference specific details relevant to their mortgage needs. Personalized mailers demonstrate attention to detail and can significantly increase engagement. - Clear Call to Action (CTA)

Every mailer should have a clear and compelling CTA. Whether it’s encouraging recipients to call for a consultation, visit a website, or attend a seminar, the CTA should be prominent and easy to follow. - Professional Design and Copy

A well-designed mailer with concise, persuasive copy reflects professionalism and builds trust. Ensure that the design aligns with your brand identity and that the message is clear and free of jargon. - Timing and Frequency

Timing plays a crucial role in the effectiveness of direct mail campaigns. Align your mailings with key periods in the borrowing cycle, such as the start of the home-buying season. Additionally, maintain a consistent but not overwhelming mailing frequency to keep your brand top-of-mind without causing recipient fatigue. - High-Quality Printing and Mailing Services

The quality of the mail piece can make a lasting impression. Investing in high-quality printing and mailing services ensures that your materials stand out in a crowded mailbox. Consider using glossy finishes, eye-catching colors, and professional layouts to enhance the visual appeal.

Optimizing Direct Mail Marketing with Data-Driven Insights

Tracking and Measuring Success

The success of direct mail campaigns hinges on the continuous analysis of performance data. Track metrics such as:

- Response rates: How many recipients took action after receiving your mail?

- Conversion rates: How many leads turned into customers?

- ROI (Return on Investment): How does the campaign cost compare to the revenue generated?

By consistently analyzing these factors, marketers can refine their strategies, improve messaging, and adjust targeting for future campaigns.

A/B Testing for Better Performance

A/B testing different versions of mailers can help identify what resonates most with your audience. Test variations in design, messaging, CTA placement, and offers to determine the most effective approach.

Integrating Direct Mail with Digital Marketing

Combining direct mail with digital marketing strategies can amplify results. For example:

- QR Codes & PURLs (Personalized URLs): Direct recipients to a landing page with exclusive offers or personalized loan information.

- Follow-Up Emails & Retargeting Ads: Reinforce the mail message through digital channels, increasing brand recall and engagement.

- Social Media & CRM Integration: Sync data with CRM tools to track engagement and automate follow-ups.

Choosing the Right Mortgage Mailing List Provider

Selecting a reliable provider is crucial to ensuring high-quality leads. Look for providers that offer:

- Accurate & Updated Data: Regularly refreshed databases to maintain list quality.

- Customization Options: Ability to filter lists based on key demographics and financial data.

- Compliance & Privacy Assurance: Adherence to legal guidelines such as the Fair Credit Reporting Act (FCRA).

Conclusion

Incorporating mortgage mailing lists into your direct mail marketing strategy enables precise targeting of high-intent borrowers, leading to improved engagement and conversion rates. By segmenting your audience, personalizing your messaging, and adhering to best practices in campaign execution, you can maximize the impact of your marketing efforts in the mortgage industry.

For more information on how to effectively utilize mortgage mailing lists in your direct mail campaigns, consider exploring resources from industry experts like MyLeadDog.com. We offer a range of products and services designed to enhance your direct mail marketing efforts, providing access to comprehensive mortgage mailing lists and expert guidance to help you reach your target audience effectively.

Additionally, industry professionals like Ed Burnett have shared valuable insights into the evolving landscape of direct mail marketing. Learn more about his perspectives and expertise by reading his book here.

Why a Mailing List of Families with High School-Aged Children is a Powerful Sales Tool

Marketing is all about reaching the right audience with the right message at the right time. If your product or service is geared toward families with high school-aged children, purchasing a targeted mailing list can be a game-changer. Whether you’re selling tutoring services, college prep courses, athletic gear, or family travel packages, having direct access to this specific demographic can significantly increase your sales and engagement. Here’s why investing in a mailing list for this niche market is a smart move.

1. A Highly Relevant Audience

Families with high schoolers have unique needs and concerns. They are actively searching for resources to support their children’s academic success, extracurricular involvement, and future plans. If your business offers solutions for SAT/ACT prep, private coaching, or even scholarship guidance, this audience is already primed to be interested in your offerings. A mailing list allows you to bypass uninterested parties and speak directly to those who are most likely to buy from you.

2. Major Life Transitions Create Buying Opportunities

The high school years are a time of major change—college decisions, first cars, prom season, and graduation. Each of these milestones comes with specific purchasing needs. Parents and students are investing in everything from test prep and tutoring to formal attire, graduation gifts, and even dorm room essentials. Businesses that cater to these needs can capitalize on these moments, offering valuable products and services at the perfect time.

3. More Efficient and Cost-Effective Marketing

One of the biggest benefits of a targeted mailing list is cost efficiency. Instead of spending money on broad, generic advertising that may not reach the right people, a mailing list ensures your promotions land in the hands of families who are most likely to be interested. This targeted approach leads to higher engagement rates, better conversion rates, and ultimately, more sales.

4. The Power of Direct Mail & Email Marketing

A high-quality mailing list allows you to connect with families through both direct mail and email marketing. Physical mailers—like postcards or brochures—can make a lasting impression, especially for big-ticket items like summer programs or educational courses. Email marketing, on the other hand, allows for quick communication, follow-ups, and special promotions. Using both channels effectively can maximize your reach and impact.

5. Building Long-Term Customer Relationships

When you acquire a mailing list, you’re not just making one-time sales—you’re opening the door to long-term customer relationships. Parents with one high schooler often have younger children who will soon enter this stage, meaning you can continue marketing to them for years to come. Additionally, satisfied customers are more likely to refer friends and family, expanding your reach through word-of-mouth marketing.

Final Thoughts

Purchasing a mailing list for families with high school-aged children is a smart investment for businesses looking to sell products and services in this niche. The combination of a highly relevant audience, major buying opportunities, cost efficiency, and the ability to build lasting customer relationships makes this strategy a valuable asset in any marketing toolkit. If you want to see increased sales and engagement, tapping into this targeted market with a well-crafted mailing campaign is the way to go.

Leveraging Data-Driven Mailing Lists to Enhance Direct Mail Campaigns

In today’s competitive marketing landscape, businesses are constantly seeking ways to maximize their return on investment (ROI). One strategy that consistently delivers results is leveraging data-driven mailing lists for direct mail marketing. By using these specialized lists, businesses can create highly targeted campaigns that not only reach the right audience but also drive meaningful engagement.

Why Data-Driven Mailing Lists Matter

Direct mail campaigns thrive on precision and relevance. Unlike generic mass mailings, data-driven mailing lists allow marketers to tailor their messaging to specific segments of their audience. These lists are curated using advanced data analytics, ensuring that your marketing efforts reach individuals who are most likely to respond to your offer.

For example, instead of sending a generic flyer to thousands of households, you can use a specialty list—such as late mortgage leads or absentee owner lists—to target individuals with specific needs or challenges. This level of precision significantly improves the likelihood of your message resonating with your audience, ultimately boosting your campaign’s response rate.

Types of Specialty Mailing Lists

- Late Mortgage Leads Homeowners struggling with late mortgage payments are more likely to be receptive to offers for refinancing or debt relief services. Targeting this group can yield higher conversion rates for businesses in the financial sector.

- Bankruptcy Lists These lists help businesses connect with individuals who may benefit from financial recovery services or affordable product offerings. By addressing their unique circumstances, your business can provide solutions that meet their needs.

- Absentee Owner Lists Absentee property owners often require specialized services such as property management, maintenance, or real estate investment opportunities. Tailoring your campaign to this audience can position your business as a trusted partner.

Benefits of Using Data-Driven Mailing Lists

- Improved Response Rates A targeted approach ensures that your mailers are sent to individuals who are more likely to take action, increasing your overall response rate.

- Cost Efficiency By focusing your resources on a well-defined audience, you reduce waste and allocate your budget more effectively. This is particularly beneficial for businesses with limited marketing resources.

- Enhanced Personalization Data-driven insights enable you to create personalized messages that resonate with your audience. Whether it’s addressing a specific challenge or offering a tailored solution, personalization builds trust and fosters engagement.

- Measurable ROI Advanced data analytics not only help you identify your target audience but also provide tools to track the success of your campaign. This data can be used to refine future marketing efforts, ensuring continuous improvement.

Real-World Example

Consider a real estate agency aiming to generate leads for investment properties. Instead of targeting a broad audience, they use an absentee owner list to focus on individuals who own properties but do not reside in them. By sending these owners tailored mailers highlighting investment opportunities, the agency sees a significant increase in inquiries and conversions. This targeted approach ensures that their marketing efforts are both efficient and impactful.

Choosing the Right Mailing List Provider

Partnering with a reputable mailing list provider is crucial to the success of your direct mail campaign. Look for providers that offer:

- Accurate and Up-to-Date Data: Ensure the data is regularly updated to maintain relevance and accuracy.

- Customization Options: The ability to tailor lists based on demographics, geographic location, or behavioral patterns.

- Advanced Analytics: Insights that help refine your targeting strategy and measure campaign performance.

One reliable provider is MyLeadDog, which offers a variety of specialty mailing lists designed to meet diverse business needs. By leveraging their expertise, you can access high-quality data that drives results.

Complementing Direct Mail with Digital Tools

While direct mail remains a powerful marketing tool, integrating it with digital strategies can amplify your results. For instance, you can use QR codes or personalized URLs (PURLs) in your mailers to drive recipients to a specific landing page. This not only enhances the customer experience but also provides valuable data on campaign performance.

Conclusion

Incorporating data-driven mailing lists for direct mail marketing into your strategy can transform your campaigns from generic to highly targeted and effective. By leveraging specialty lists and advanced analytics, businesses can reach the right audience, improve response rates, and achieve a higher ROI.

Ready to elevate your direct mail campaigns? Explore the range of specialty mailing lists available at Lead Dog Information Services. Then, contact us to learn how you can start driving results today.

Seasonal Strategies for Targeting New Homeowners and Distressed Property Leads in 2025

Seasonal Strategies for Targeting New Homeowners and Distressed Property Leads in 2025

In 2025, the real estate market remains dynamic, offering ample opportunities for businesses to target new homeowners and distressed property leads effectively. With the increasing reliance on data-driven strategies and personalization, direct marketing leads have become a cornerstone of successful campaigns. This blog explores seasonal strategies for reaching these key demographics, highlighting the importance of tailored messaging and providing actionable tips for achieving high conversion rates.

The Growing Importance of New Homeowners and Distressed Property Leads

According to recent projections, approximately 5.5 million homes are expected to be sold in the U.S. in 2025, with a significant portion being first-time buyers or individuals relocating to new areas. This presents a lucrative opportunity for businesses offering home-related products or services. Similarly, the late mortgage market continues to grow, with estimates suggesting that 1 in every 1,300 U.S. properties will face foreclosure in 2025. Real estate investors and businesses specializing in distressed properties can benefit from targeting this niche.

By focusing on these groups, marketers can address pressing needs, such as home maintenance, furnishings, financial solutions, and investment opportunities. Leveraging personalized marketing strategies, especially through mail campaigns, ensures that businesses connect with their targeted audience effectively.

Why Direct Marketing Leads Matter in 2025

The direct marketing landscape in 2025 prioritizes personalization, data integration, and omnichannel approaches. Statistics show that 76% of consumers are more likely to act on personalized mail pieces, and targeted direct mail campaigns yield an average 29% higher response rate than non-targeted efforts. For marketers, this underscores the importance of crafting tailored mail campaigns that resonate with specific demographics, such as new homeowners and distressed property owners.

Seasonal Strategies for Targeting New Homeowners

Seasonal marketing strategies can help businesses align their campaigns with the evolving needs of new homeowners throughout the year. Here’s how to approach each season effectively:

- Spring: The Moving Season

- Why it Works: Spring is the peak moving season, with 70% of moves occurring between April and September. New homeowners are eager to settle in and invest in services or products that enhance their living spaces.

- Strategy: Launch a mail campaign highlighting springtime offers on home improvement services, landscaping, or cleaning solutions. Include a personalized touch by addressing the recipient’s recent move.

- Message: “Welcome to Your New Home! Kickstart Your Spring Projects with Exclusive Discounts on [Your Service/Product].”

- Summer: Outdoor Living and Maintenance

- Why it Works: Summer is synonymous with outdoor activities and home maintenance. New homeowners often invest in landscaping, patio furniture, or pool services during this season.

- Strategy: Send visually appealing mail pieces featuring summer specials on outdoor living products or maintenance packages. Highlight the convenience and quality of your offerings.

- Message: “Transform Your Backyard into a Summer Oasis with Our Limited-Time Deals!”

- Fall: Preparing for the Holidays

- Why it Works: Fall is a transitional season when homeowners focus on preparing their homes for the holidays and colder months.

- Strategy: Target your audience with mail campaigns promoting home insulation, HVAC services, or holiday décor. Emphasize the urgency of acting before winter.

- Message: “Get Your Home Holiday-Ready! Special Discounts on [Service/Product] Until [Date].”

- Winter: Comfort and Upgrades

- Why it Works: Winter is a time for indoor upgrades and cozy comforts. New homeowners may seek heating solutions, interior design services, or winter-proofing for their homes.

- Strategy: Focus your mail campaigns on products or services that enhance indoor living. Offer promotions on heating systems, energy audits, or smart home devices.

- Message: “Stay Warm and Save Energy! Exclusive Winter Deals on [Your Service/Product].”

Strategies for Targeting Distressed Property Leads

Distressed properties, including late mortgages, offer a unique opportunity for real estate investors and service providers. Here are effective lead generation strategies for this audience:

- Data-Driven Targeting

- Use property databases, foreclosure listings, and real estate platforms to identify distressed properties. Lead Dog Information Services can provide comprehensive data on late mortgage leads.

- Segment your targeted audience based on property type, location, and urgency of need.

- Compelling Messaging

- Craft empathetic and solution-oriented messages for late and pre-foreclosure recipients. Address the recipient’s challenges and present your services as a way to alleviate their concerns.

- Example Message: “Facing Financial Difficulties? Let Us Help You Navigate Your Options and Protect Your Home.”

- Seasonal Incentives

- Offer seasonal incentives tailored to distressed property owners, such as discounted repair services or financial consultations.

- Example: “Start the New Year with a Fresh Start. Exclusive Discounts on Home Repairs.”

Crafting Personalized Mail Campaigns

Personalization is the backbone of successful direct mail campaigns. Here’s how to create compelling messages for new homeowners and distressed property leads:

- Understand Your Audience

- Use demographic and psychographic data to tailor your messaging. For instance, first-time homeowners may prioritize budget-friendly offers, while distressed property owners may seek financial relief.

- Include a Clear Call-to-Action (CTA)

- Encourage immediate action by including a clear and compelling CTA. Examples include “Call Today for a Free Consultation” or “Scan the QR Code to Claim Your Discount.”

- Use High-Quality Design

- Invest in visually appealing mail pieces with vibrant colors, high-resolution images, and easy-to-read fonts. A professional design enhances credibility and grabs attention.

- Highlight Benefits

- Focus on the value your service or product provides. Instead of listing features, emphasize how it solves a problem or improves the recipient’s life.

- Example: “Save Time and Money with Our All-in-One Home Maintenance Package.”

Measuring Success: Conversion Rates and ROI

To ensure the effectiveness of your campaigns, track key metrics such as response rates, conversion rates, and return on investment (ROI). Industry benchmarks indicate that direct mail campaigns targeting homeowners often achieve response rates of up to 2%, significantly higher than email campaigns.

Use Lead Dog Information Services to integrate mail campaigns into your broader marketing strategy and monitor performance. A/B testing different messages, designs, and seasonal offers can further optimize results.

Final Thoughts

Targeting new homeowners and distressed property leads in 2025 requires a blend of seasonal strategies, personalized messaging, and data-driven insights. By crafting compelling mail campaigns and focusing on the unique needs of your targeted audience, you can achieve higher conversion rates and build lasting customer relationships. As the market continues to evolve, staying adaptable and innovative will ensure your marketing strategy remains effective.

How to Use Pre-Foreclosure and Absentee Owner Lists to Boost Real Estate Investment Returns

When considering real estate investments, one may wonder if foreclosures are a viable option. While they can be profitable, delving into the pre-foreclosure market requires a high level of expertise and dedication that many may not anticipate. Although the potential for returns is significant, reaping the benefits from investing in foreclosures demands a substantial amount of effort.

Key Takeaways:

Investing in the foreclosure market can be highly profitable, but it requires dedication and effort.

Investors should develop clear strategies outlining their reasons for investing in properties, methods for acquisition, and plans for utilization or disposal. Thorough research is essential for success in this market, including an in-depth analysis of the local real estate market, individual properties, state and local regulations, and the overall economic climate.

Foreclosure investing is a significant financial endeavor that demands focus, diligence, and thorough research into local property, economic, and demographic trends. It necessitates the development of a strategic plan for acquiring properties and ultimately selling them for profit.

Engaging in pre-foreclosure investing is not for amateurs. It is akin to buying used cars at auction, where experienced dealers possess in-depth knowledge of various makes and models, common defects, and how to enhance value. These professionals take calculated risks, unlike individuals who attend auctions seeking discounted purchases without a comprehensive understanding of the investment or risk management strategies.

Many novice foreclosure buyers attend courthouse auctions with hopes of securing a bargain based on the price disparity from the property’s intrinsic value. However, relying solely on price differentials for investment income is a risky approach. Seasoned investors in the residential pre-foreclosure market recognize the importance of selecting properties strategically, focusing on locations poised for redevelopment or improvement, and possessing unique attributes that set them apart in the local market.

Developing a well-thought-out investment strategy is crucial for success in real estate, especially in the foreclosure market. This strategy should outline goals, methods for property acquisition, holding strategies, and exit plans. Understanding the circumstances leading to the pre-foreclosure, whether due to individual misfortune or broader market trends, is essential for making informed investment decisions.

Acquisition Strategies

Many investors have been trained to search through publications listing assets up for auction and then contact owners to express interest in purchasing the property before it goes to auction. While deals can certainly be found at auctions, exploring alternative methods to acquire distressed properties can significantly increase the likelihood of successfully closing a deal. It also presents an opportunity to thoroughly understand and analyze the property.

For instance, consider an investor who gains access to properties by leveraging their network in the market and expertise in residential lending to assist struggling homeowners in negotiating with their lenders. By resolving loan issues, the investor not only enhances their reputation with both the homeowners and lenders but also opens the door to potential referrals from others facing similar challenges. In cases where a resolution cannot be reached, the investor is positioned at the forefront to acquire the property due to the trust established with the owners. Armed with a deeper understanding of the property’s strengths and weaknesses, investors can make well-informed decisions on whether to proceed with the purchase.

Another effective strategy involves purchasing distressed loans at a discounted rate from lenders. Banks and other financial institutions typically prefer to avoid acquiring foreclosed properties. To prevent taking on real estate owned (REO) properties, these institutions often sell nonperforming loans at a substantial discount. Investors have more flexibility than lenders in renegotiating nonperforming loans, sometimes converting them into performing loans that yield higher returns due to the investor’s lower initial investment. After allowing the loans to mature, investors can choose to retain them or sell them at a premium once they have demonstrated consistent performance over time.

In the event that the loans cannot be resolved, the investor has the option to foreclose on the property and take the title without facing competition from other parties. However, this approach requires a larger capital investment compared to purchasing individual properties at auction. The key takeaway is that there are innovative methods to minimize competition when acquiring a nonperforming asset.

Ownership Strategies

Investors must also have a clear plan for what to do once they acquire the asset. Will the property be quickly resold, or will it be held onto until the market conditions are more favorable for a sale?

Property Flipping Using Pre Foreclosure Lists

Investors interested in purchasing foreclosed properties and reselling them shortly after acquisition should focus on enhancing the property. Effective strategies include adding bedrooms and bathrooms, renovating kitchens, and finishing basements or other unused spaces.

Since property transaction details are publicly available, some potential buyers may be hesitant to pay a premium for a property immediately following a pre-foreclosure sale, even if its price aligns with other properties in the area. Creating value through redevelopment can justify a higher resale price and reduce the risk of extended marketing periods. However, investors should be cautious not to over-improve the property to the extent that its price significantly exceeds neighboring properties.

It is unwise to invest in extensive improvements for a foreclosed home that would price it out of the market.

Property Holding Strategy

One effective strategy in real estate investment is to hold assets as rental properties until market conditions improve and property values increase. Investors must have a deep understanding of the rental market to ensure there is sufficient demand for rental space and that the property can generate enough rent to cover maintenance costs.

For those willing to take on the responsibilities of being a landlord, purchasing distressed properties at a discount and converting them into rental properties can lead to significant wealth accumulation. Securing attractive financing options, such as interest-only loans, along with the tax deductibility of mortgage interest, can help create cash flow while waiting for the right time to sell.

While residential real estate is less volatile than other asset classes, it often experiences long periods of low returns followed by spikes in value due to changes in demand. This underscores the importance of ongoing research and a holding-period strategy to estimate the timing of value increases and prepare for the eventual sale of the asset.

Exit Strategies

Failing to plan an exit strategy is a common mistake made by new investors. Many believe that investing in foreclosure properties is best when there is an abundance available. However, a surplus of homes for sale and foreclosure properties may indicate underlying issues such as job losses or infrastructure problems in the area, making it less desirable for potential buyers. It is crucial to consider these factors when developing an exit strategy for real estate investments.

The current trends in the real estate market are expected to have a positive impact on the supply of available homes for sale or pre-foreclosures, while simultaneously having a negative impact on demand. This means that selling a property may prove to be more challenging until market conditions improve.

One common mistake that investors often make is solely focusing on the pricing differential for profit, without considering the negative effects of carrying costs. These expenses can include mortgage payments, taxes, insurance, and maintenance during an extended marketing and sales period.

To mitigate excess carrying costs, one effective strategy is to set a deadline for selling a property and then gradually reduce the price until a buyer is found. It is preferable to sell at a minimal profit or break-even point rather than holding onto a property at a price that will result in prolonged marketing efforts and accumulating carrying costs that could lead to financial losses.

In conclusion, investing in nonperforming real estate assets as a means to build wealth is a viable strategy, but it is not a get-rich-quick scheme. Success in the foreclosure market requires diligent study of successful investors’ strategies and tactics, as well as establishing valuable market contacts to gain a competitive edge.

Ultimately, achieving success in real estate investing hinges on implementing smart, well-thought-out acquisition and exit strategies. By dedicating time and resources to understanding the local real estate market and leveraging various tactics, investors can position themselves ahead of the competition and increase their chances of success.

3 Top Mistakes Companies Make with Email Campaigns and How to Avoid Them

1. Neglecting Mobile Optimization in Campaign Design

In today’s digital landscape, more than half of all emails are opened on mobile devices. Failing to optimize emails for mobile can result in a subpar experience for subscribers. An email that is not optimized for mobile may cut off the subject line, leading to decreased open rates. Additionally, slow-loading images, incorrect rendering, or a confusing user experience can prompt readers to immediately delete the email.

Regardless of the type of campaign you are running, it is crucial to remember that at least half of your audience will be viewing your email on a mobile device. Neglecting mobile optimization can alienate a significant portion of your potential customer base, ultimately hindering the success of your campaign.

2. Overlooking Personalization

Email marketing is a powerful tool because it provides direct access to your target audience’s information. It is essential for marketers to leverage this data effectively. Many email marketers make the mistake of sending generic email blasts to all subscribers when they could be personalizing their messages. Personalized emails can capture the attention of subscribers, foster brand loyalty, and set your business apart from competitors.

Explore opportunities to send personalized emails that make customers feel valued and unique, rather than just another name on a list. Additionally, consider segmenting your email list based on specific demographics to tailor campaigns to the preferences of different subscriber groups. While not every email needs to be individually customized, incorporating some level of personalization can significantly improve open rates, click-through rates, and ultimately drive sales.

3. Failing to Plan

Imagine you are trying to navigate to a new destination in an unfamiliar city. Do you rely on your GPS for guidance, or do you simply trust your instincts and hope to stumble upon your destination? Chances are, you would opt for the former and plan ahead to ensure a smooth journey. The same principle applies to your email marketing strategy. Embarking on a campaign

without a well-thought-out plan is a costly mistake that can waste both time and money.

One of the pitfalls of not having a plan is haphazardly sending out campaign emails whenever the mood strikes. This can result in poor scheduling, leading to an excessive number of emails being sent in a short period or, conversely, not enough emails being sent. (It is generally recommended to reach out to subscribers at least twice a month.) Without a solid plan, it becomes challenging to craft tailored emails for each segment of your email list. Consequently, you risk sending generic emails that fail to resonate with recipients, resulting in higher unsubscribe rates and diminished engagement.

To ensure that your email lists and databases are accurate and up to date, get in touch with us today to learn how our email appending services. Clean and accurate customer data can help you reach your email campaign goals.

The Importance of Segmenting Your Target Audience According to Lifestyle

There are many ways to segment your target audience. Age and income level are just a few of those ways. Segmenting your target audience helps to address the needs and wants of specific individuals and increases the chances that your marketing efforts will be successful.

When you recognize the differences between particular audiences, you can better pinpoint your marketing message so that it appeals to the customers and prospects most likely to be interested in your products or service. Segmenting your target audience also helps you to stand out from competitors that rely on a more generic marketing message.

Generally speaking, segmenting your target audience usually falls into rather predictable patterns such as the ones listed above. If you really want to be successful in reaching qualified leads or you have a niche product or service that will appeal to a very specific audience, you might want to consider lifestyle segmentation.

Lifestyle segmentation breaks down information about potential customers into small subsets. Once you identify these consumers by lifestyle you are more likely to convert them into customers because you are offering something that appeals specifically to them. Another bonus of lifestyle segmentation is that once these individuals make a purchase they are very likely to become loyal customers.

While it can be difficult to segment prospects by lifestyle because of the wide range of options, there are four key aspects to consider:

- Behavioral. Under what circumstances are your prospects likely to purchase a particular product?

- Demographic. What is the age, gender, marital status and race of your prospects?

- Geographic. Where will your potential customers likely buy or use your products?

- Psychographic. How are these prospects unique in terms of personal preferences and lifestyle choices?

When it comes to lifestyle segmentation it is important to remember that this type of segmentation is more fluid than traditional segments. However, once a prospect has converted into a buyer, you should be able to take advantage of the long-term revenue and profits that the buyer represents.

You also should remember that the more your solutions enhance the quality of the life of a customer who was segmented by lifestyle, the more likely it will be that you can up- or cross-sell to that customer. These customers also are exceptionally likely to refer you to friends and family.

How to Market to Bankruptcy Leads

When it comes to the special finance market, there often is more than meets the eye. In other words, there is no one way sure-fire way to market to customers and prospects who are having credit problems.

Most experts agree that bankruptcies are the bread and butter of any company that is interested in the subprime lending market. This is especially true if you have the perfect mix of lenders, inventory and marketing methods.

In the past, those who had filed for bankruptcy would only be approved for financing after seven years but over time that period has continued to shrink, with some lenders willing to provide financing immediately after someone has filed for bankruptcy. Also disappearing are restrictions on the type of bankruptcies subprime lenders are willing to approve.

One important thing to keep in mind about the bankruptcy funding market is that it is anything but static. Each and every day new consumers come into the market. These individuals are knee-deep in financial difficulties. In many cases, after a period of time, they will have recovered from their financial difficulties, however, and are ready to move forward with more expensive purchases. For example, they will have gone from wanting the cheapest car to get them from home to work and back to purchasing a new car.

Working with these individuals over the long haul provides the opportunity to remain in contact with these them so that they will come to see you as more than just a subprime lender. Instead, they will see you as a partner, remembering that you were there for them when no one else was.

If you are looking to market to individuals who have filed for bankruptcy, here are some important things to keep in mind when approaching these prospects:

- Be open and honest. Don’t use terms like pre-approved and pre-qualified haphazardly. Instead, offer them an invitation to apply.

- Be sensitive. Don’t shame recipients or try to scare them into working with you. Many of these individuals are surprised to learn that they can obtain financing. Letting them know that you would like to help them will go a long way toward gaining their trust and their business.

- Don’t generalize. Not everyone who has filed for bankruptcy has the same story. Don’t try to guess about their specific circumstances.

- Always include a call-to-action. Don’t make a prospect guess how to contact you or what their next step should be. Instead, give them a toll-free number or direct them to a specific landing page on your website.

Obtaining an accurate bankruptcy list is an important first step when it comes to working with those who have filed for bankruptcy. How you handle the leads on this list, however, will make a huge difference when it comes to capitalizing on it.

The Ins and Outs of Email and Data Appends

If you are looking to obtain new email subscribers and improve the quality of existing ones, you should consider email append. And when used with your email marketing campaigns, data append can drastically improve your success rate. So, what is the difference between email and data append?

In the simplest terms, email append adds valid email addresses to contacts in your database. These contacts usually fall into one of the following categories:

- Contacts with no email address

- Contacts with old or outdated email addresses

- Contacts with an email address that you are not sure are valid

- Contacts that may have a more current email address

It also is important to keep in mind that it is best only to append email addresses under the following circumstances:

- An individual has opted-in to receive emails from you

- You have a prior relationship with this person

- The individual has not opted out of your email programs

Email appends begin by establishing the segment of data to add email addresses. Running an email hygiene report is necessary to identify the segments. Verification is then conducted to find out if the email addresses on file are current and active. Those that are not should be flagged.

It is important to find a reputable company that offers email verification and append services. That provider will process the data and assign email addresses to the missing files. Most append projects will add new email addresses to approximately 25 percent of your file.

Once you have the new emails you will want to reach out to your contacts. Not only will this process give recipients the option of opting out of your emails, but you can also identify undeliverable emails.

So what about data append? Data append is basically an email append in reverse. You are adding data or information about an individual on your email list to better target that person. What follows are some examples of the information you might want to add through data append: address, age, birth month or income. Of course, these are just the beginning. The options are literally endless for the type of information you can add using data append.

Data append is used mostly for individuals, but households also are an option. If an email address is not available for the person you are looking for, you can check if there is anyone else living at the address, for example, a spouse. You can then decide if it makes sense to contact the spouse.

Direct Mail Continues to Offer a Strong ROI

In today’s digital age, many marketers have come to the conclusion that direct mail is no longer a useful technique. However, nothing could be further from the truth. According to a recent survey, 70 percent of Americans say they believe direct mail to be more personal than online advertising. That’s something savvy businesses recognize.

From 2015 to 2016, the amount of spent on direct mail marketing grew by more than a billion dollars, from $47.2 billion to $48.4 billion. This increase in spending can be contributed to strong response rates and a healthy return on investment.

Of course, the success of any direct mail campaign can be directly linked to the quality of that campaign. If you are considering direct mail for your business, here are some ways to make sure that your campaign is as successful as possible.

-

- Keep it simple. Americans are busy and don’t have time to pour over long blocks of copy. Make sure the copy on your direct mail piece is short and to the point. An attention-grabbing headline also is crucial.

- Make it pleasing to the eye. Visuals can make or break a direct mail piece. A crisp design or stunning photos will draw in recipients perhaps more than any other element.

- Integrate. While a direct mail campaign can stand on its own, integrating it with other types of marketing will help to drive home its message. Consider following up your direct mail piece with an email, for example. The more touches a marketing campaign has, the more likely recipients will be to remember the message.

- Personalize. Make sure you include the name of the recipient on your direct mail piece to give it a more personal touch. Personalized pieces are significantly more impactful than those that are not personalized.

- Test. No matter how effective your direct mail piece, it can always be better. The more elements you test, the greater results your campaign will achieve.

- Target. No matter how visually stunning, well-written and creative your direct mail piece is, if it isn’t going to the correct target audience, it won’t achieve the results it should. If you are marketing to real estate investors looking for vacant property lists, for example, you don’t want your direct mail piece to go to everyone in the real estate industry. Make sure you aren’t wasting your time and money on individuals or businesses that have no need for what you are selling.

Direct mail is alive and well in 2018. The key is to make sure you are doing all you can to make sure your campaign stands out from the competition and reaches your target audience.